TL;DR

Bitcoin dropped over 15% to $107,000 amid a $19B liquidation — the largest in crypto history.

Quantum computing “threats” to Bitcoin resurfaced, but remain years away from practical impact.

PayPal’s PYUSD briefly made headlines after Paxos accidentally minted 300 trillion tokens.

Gold and silver hit new all-time highs — a signal of deepening distrust in fiat systems.

Despite volatility, over 60% of Bitcoin hasn’t moved in a year — conviction remains strong.

Hard Money Dispatch: Week of October 13, 2025

Welcome back!

Bitcoin has fallen over 15% to it’s lowest level since June, currently sitting at $107,000.

Some think this marks the end of the bull market, while others believe it’s the final flush out before a blow-off top. Either way, we’re likely approaching the end of this market euphoria, with 2026 looking like a possible bear market year.

It reminds me of this meme:

Let’s look at some highlights from the week of October 13.

Quantum Computing FUD (Again)

I really thought this story was going away for a while, but it’s not. The quantum fear-mongers’ never seem to get tired of repeating the same misleading narratives.

To be clear, I’m not oblivious to the potential threat of quantum computers. It’s a real technology that could have real implications for Bitcoin and altcoins one day in the distant future.

But the way it’s often framed is entirely misinformed.

Some people seem to think that ECDSA, the encryption that protects Bitcoin wallets, will be broken by quantum computers in the next 2 years.

First off, note that if your coins are in a wallet that hasn’t been spent from, this is not a threat. That’s because your public keys are only exposed when you send a transaction from a wallet, and quantum computers could potentially derive private keys from public keys, meaning they could steal coins simply by seeing someone’s wallet address.

But even so, some people still say it’s a problem. After all, Satoshi’s lost wallet holds 1 million BTC, and there are plenty of lost coins out there that hackers could target (who these mysterious quantum hackers would be is another question entirely).

The hackers could then sell these coins on the open market, tanking the price, or so the theory goes.

But this doesn’t make sense for a lot of reasons (bear with me while I introduce some technical terms here).

First, it would take at least 2,000 logical qubits to break ECDSA in a timeframe of two years, and current quantum computers have about 100. It’s projected that within 4 or 5 years, they will reach over 2,000 qubits.

In other words, quantum computers will only be capable of hacking bitcoin wallets five years from now, and from that point, it will take another two years to crack the necessary encryption. That leaves seven years minimum until the threat might become reality. And that’s not to mention the fact that breakthroughs in physics, math, and engineering would likely be required to create quantum computers that could reliably run practical applications, which would be necessary to keep them up and running for two years straight.

By the way, there are no such practical applications today, and not a single company that focuses solely on quantum computing has any real revenue.

There’s a whole lot more to the story, but I’ll keep things brief for now. I had to research this topic extensively for a project I worked on in late 2024 when Google announced its latest quantum chip, Willow, so while I’m no expert on quantum physics or computing, I can at least dispel some of the most obvious misinformation floating around.

Momentary Crypto Market Collapse

Friday October 10 saw the biggest crypto liquidation event in history. More money was wiped out at this time than ever before. During the last 16 years since Bitcoin’s inception, only a few events compare: Covid in 2020, China’s mining ban in 2021, and the FTX collapse in 2022. But even those were minor in comparison, with only a few billion in liquidations.

On October 10, over $19 billion in leveraged positions were liquidated, meaning traders who placed bets using leverage (borrowed money) lost everything. https://cointelegraph.com/news/19b-crypto-market-crash-leverage-china-tariffs

What exactly happened on the 10th of October?

Rob Wallace from Bitcoin News summarized the situation eloquently on LinkedIn:

Over $19 billion in positions were wiped out across centralized exchanges.

More than 1.6 million traders were liquidated with their accounts zeroed out in an instant.

In just one hour, Bitcoin fell 13% from peak to trough.

Altcoins, of course, suffered far worse.

ATOM, a vaporware token with a $2 billion market cap before the flash crash, briefly traded to zero before rebounding.

Prices have recovered from those extreme lows, but this was historic, nearly double the size of the second-largest liquidation event, 2021’s China mining ban sell-off.

…For leveraged traders and long-only funds, Friday was a wipeout.

But for long-term Bitcoin holders, it was just another Friday.

On-chain data shows over 60% of Bitcoin hasn’t moved in more than a year.

Treasury and ETF institutional wallets, holding over 2 million BTC, didn’t react at all as those markets were closed.

While $11 billion in Bitcoin open interest was cleared, history shows every major leverage flush like this, such as in 2020, 2021, and 2023, has reset the market and paved the way for stronger rallies.

In many ways, this weekend was a bull run reset.

…Ultimately, nothing beats Bitcoin in cold storage.

One key idea there I’d like to point out is that over 60% of BTC hasn’t moved in over a year. Last week, I pointed out the 5-year record low bitcoin balance on exchanges. Together, these two facts point to a large majority of holders maintaining their positions for the long term rather than speculating on short-term price movements.

Despite recent price declines, BTC/USD is only about 17% off its record highs at the time of this writing.

Most altcoins have fared worse, with XRP being down more than 30% off its highs, and SOL down about 20%.

Paxos Accidentally Mints 300 Trillion PYUSD

PayPal’s stablecoin, PYUSD, made headlines this week. Someone minted 300 trillion PYUSD tokens before burning them. The tokens were created on the DeFi platform Aave, then sent to an inaccessible address 22 minutes later.

The price of PYUSD maintained its peg to the US dollar, although the price briefly dropped by about 5 cents on the news.

This is a good reminder as to why stablecoins might not be a stable as commonly thought.

Gold and Silver Continue Historic Rally

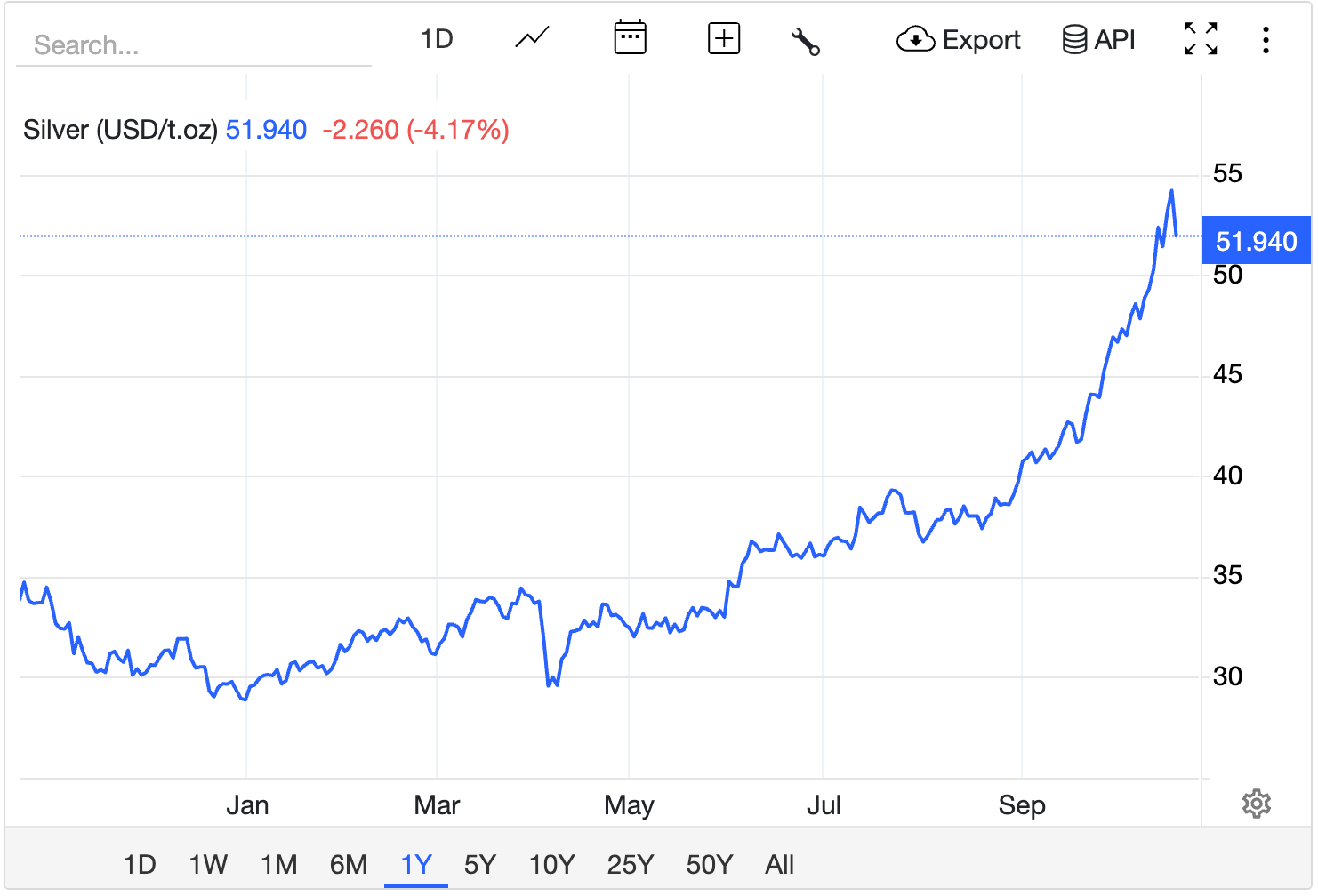

Gold has been smashing through record high after record high recently. Even silver has made a new all-time high above $50.

1-year silver/USD chart. Source: Tradingeconomics.com

After nearly fifteen years of stagnation, the precious metals market has finally awakened.

While this may be a good thing for those invested in this market, it could signal something ominous on the horizon.

Gold and silver are viewed as the traditional safe haven assets, and they’re being bought aggressively. Governments, central banks, institutions and individuals all buy gold when they either 1) lose faith in their national currency, or 2) expect a crisis of some kind.

While it remains to be seen exactly why gold and silver are seeing such intense bids, some believe it’s due to artificial intelligence (AI). The monumental energy requirements of AI infrastructure will require funding, and if that funding comes from national governments, they will have to print a lot of money to that end.

This thesis was articulated by Zerohedge, with a response from Elon Musk:

More on the subject here: https://cryptonews.com/news/elon-musk-calls-bitcoin-energy-money-says-its-impossible-to-fake-unlike-fiat-new-ath-coming/

Thanks for reading, and if you’re not already subscribed, click here: