TL;DR

Bitcoin just hit a new all-time high above $125,000, aligning with its historical pattern of explosive Q4 gains in post-halving years.

Exchange balances are at a 5-year low, signaling rising demand and tightening supply—a bullish setup.

Historical echo: In 2020, MicroStrategy and Paul Tudor Jones legitimized Bitcoin as a hedge against inflation; today, both remain key players, reinforcing that thesis.

Institutions are all-in—Saylor’s firm now holds over 640,000 BTC; the top 100 treasury holders own 1.04 million BTC collectively.

Thesis remains simple: Scarce assets like Bitcoin will continue appreciating as fiat currencies are printed into oblivion. The goal? $1 million BTC—and beyond.

“Uptober” started off with a bang this month as bitcoin broke out to a new all-time high above $125,000.

This should come as no surprise, given that the fourth quarter of the post-halving year has historically been the most explosive period for bitcoin’s price (by the way, here’s an article I wrote about the halving for Finance Magnates in March 2024: https://www.financemagnates.com/cryptocurrency/bitcoin-halving-2024-and-the-crypto-industry-what-to-watch-out-for/)

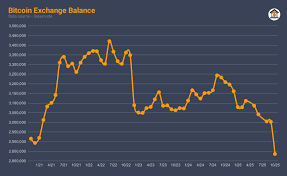

Perhaps even more importantly, the balance of bitcoin on exchanges has dropped to a 5-year low:

Image credit: CryptosrUS via Instagram

But before moving on, looking at the past can provide helpful context for where we are today. Let’s look at where things were around this time five years ago.

During the summer of 2020 when BTC/USD was about $9,000, two of the biggest news stories to ever happen in the space up until that point broke:

1) Microstrategy (MSTR), a publicly-traded business intelligence company, had begun adding bitcoin to its balance sheet, and

2) Paul Tudor Jones, a famous billionaire investor and hedge fund manager, appeared on mainstream financial news and said that a “great monetary inflation” was coming, that investors should be on “the fastest horse in the race,” and that he was therefore allocating 1% - 2% of his portfolio to bitcoin.

At the time, this was seen as validation for a thesis that many had been trying to shout from the rooftops for years: that bitcoin presented a once-in-a-generation opportunity to preserve purchasing power amidst the inflationary policies of central banks.

Of course, during 2020 alone, countless trillions of US dollars were created out of thin air. In that environment, the message became a lot clearer.

Then-CEO of Microstrategy, Michael Saylor, who once denied bitcoin’s utility years before, famously said that his company was “sitting on a melting ice cube” of cash that was constantly being debased by money printing. Converting that cash to bitcoin was the only hope his company had to survive.

Saylor even started Hope.com, claiming that bitcoin is hope for 8 billion people who previously had no way to escape the theft of their labor due to inflation.

In October 2025, we find ourselves little more than five years into the future. At this point, Michael Saylor has accumulated over 640,000 BTC through Strategy, and sparked a gold rush among a long and growing list of so-called Bitcoin treasury companies.

The top 100 of these companies hold a collective 1.04 million BTC.

And once again, similar to 2020, Paul Tudor Jones is saying that the current bull market still has room to run. From Cointelegraph:

“Billionaire investor Paul Tudor Jones said US financial markets are far from a bubble and points to the US government’s growing fiscal crisis as a catalyst for risk-on assets, including Bitcoin...Tudor’s main thesis relies on loose monetary policies, retail flows and speculation.”

You can read more of Jones’ latest comments here on CNBC: https://www.cnbc.com/2025/10/06/paul-tudor-jones-says-ingredients-are-in-place-for-massive-rally-before-a-blow-off-top-to-bull-market.html

To summarize all of this, it’s a simple strategy: buy things that are scarce and desirable, as their prices must increase in a world with rising uncertainty and money printing. JP Morgan has recently dubbed this trade the “debasement trade,” lending even more credence to this ideology.

It comes down to supply and demand. An infinite and growing amount of fiat currency units (dollars, euros, yen, etc) continue to chase a shrinking amount of bitcoin, gold, and related stocks like gold miners and bitcoin miners.

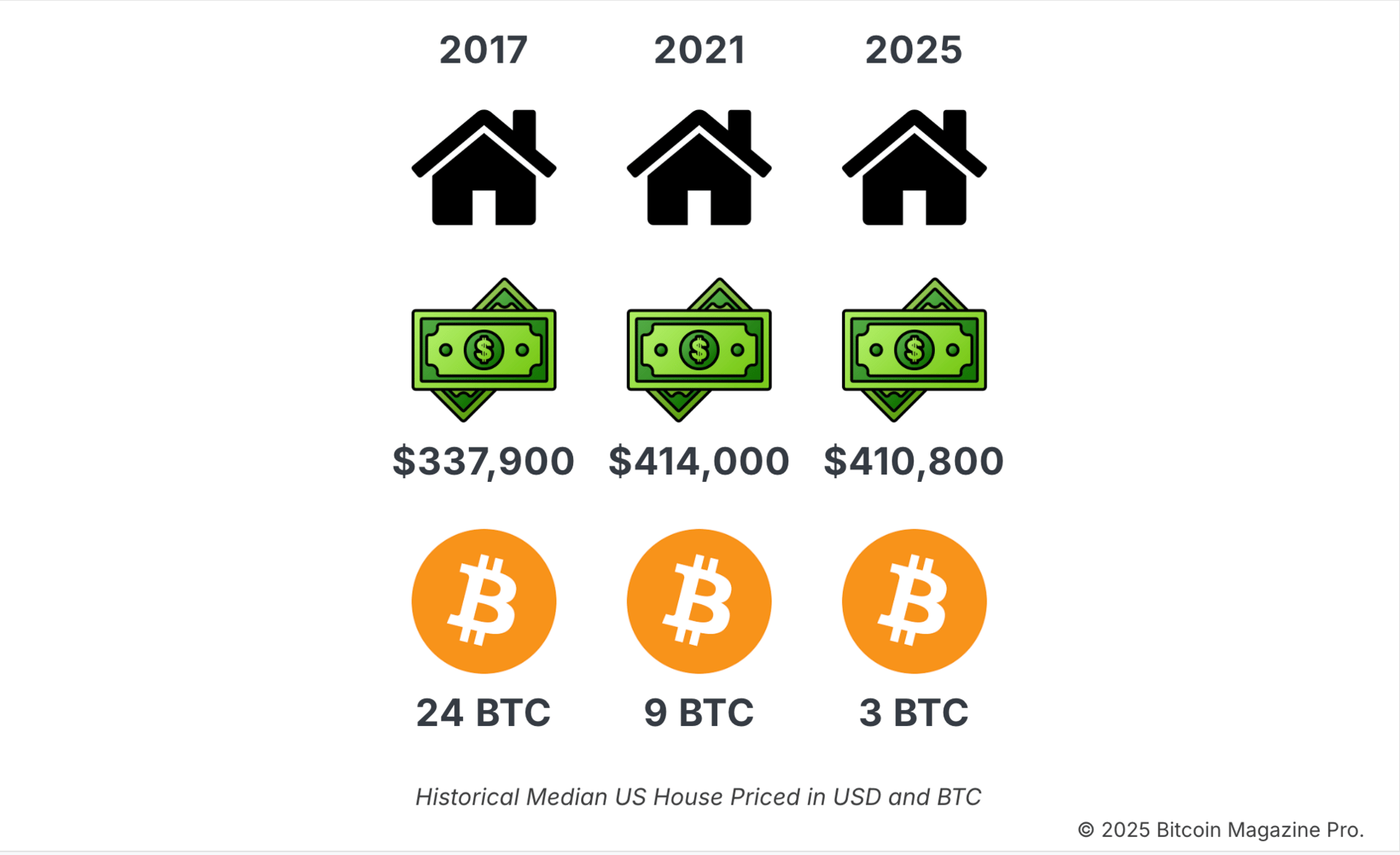

This imbalance leads to rising prices in the scarce and desirable assets. Put differently, prices continue to fall in bitcoin terms. Look at this graphic by Bitcoin Magazine illustrating the dramatic decline in housing prices as measured in BTC:

Image credit: Bitcoin Magazine

In closing, no one today is “too late” to bitcoin.

Yes, the opportunity to front run Wall Street may have passed in January 2024 when the first bitcoin ETFs were approved.

But the price of bitcoin as measured in US dollars has only tripled since then, which is not that big of a move by bitcoin’s standards.

Bitcoin is currently the 7th largest asset in the world. It will one day be the 1st largest asset. Michael Saylor believes this will happen within the next 48 months, although I think that timeframe is a bit optimistic.

Still, at some point, bitcoin will eclipse gold’s market cap of over $20 trillion, due to being a superior store of value. That implies a price of $1,000,000 per bitcoin. And even beyond that point, there’s still $400 trillion worth of financial capital in the world, on top of over $600 trillion in debt. A significant portion of that capital will eventually find its way into bitcoin, as more people begin to understand that a better store of value never has and never will exist.

It might be wise to act accordingly while there’s still time.