🔏 TL:DR

Markets pull back hard: Bitcoin and crypto have seen a sharp sell-off, erasing months of gains and reminding investors that volatility is part of the process.

History repeats: Each major cycle brings a shakeout. Leverage gets flushed, weak hands exit, and long-term holders prepare for the next phase.

Macro pressure builds: Global liquidity is tightening, the Fed remains unpredictable, and risk assets are taking a hit.

Core v30 controversy: Bitcoin Core’s new update allowing arbitrary data embedding has sparked community debate and renewed FUD—but alternative implementations are emerging.

Long-term thesis intact: Bitcoin’s fundamentals haven’t changed. Volatility keeps declining, and the 200-week moving average continues its historic upward trend.

📉 Bitcoin & Crypto Markets Decline

The past few weeks have been brutal for Bitcoin and the broader crypto market. Prices have slid sharply, wiping out months of gains and reminding everyone that volatility cuts both ways. Fear has crept back in. Social feeds are full of charts, predictions, and panic..

Looking back, every major Bitcoin cycle has included moments like this. After euphoric rallies, the market breathes out. Excess leverage gets flushed, weak hands capitulate, and liquidity returns to those who understand what they hold. In 2021, we saw a similar unwind after speculative mania hit its peak. Those who stayed patient were rewarded when the next accumulation phase began.

This time, the sell-off coincides with tightening liquidity across global markets. The Fed’s mixed signals, rising debt levels, and continued macro uncertainty have pushed investors toward risk-off positioning. Stablecoin redemptions and forced liquidations have amplified the move.

[Here’s a great read from Cointelegraph on the subject: https://cointelegraph.com/news/bitcoin-falls-to-dollar98k-as-futures-liquidations-soar-should-bulls-expect-a-bounce ]

Yet Bitcoin’s fundamentals haven’t changed. Blocks keep coming. Supply issuance remains fixed.

The only thing that gives me some pause is what’s been happening with Bitcoin Core v30, which allows anyone to embed anything into Bitcoin transactions. This has created a divide in the Bitcoin community, has a lot of people concerned, and may be contributing to fear, uncertainty, and doubt. Still, there’s plenty of hope, as progress is being made to provide alternative versions of the software.

More on the subject later on.

🚀 Long-Term, the Trend is Clear

While Bitcoin goes through bouts of extreme volatility on a regular basis, two things are worth noting:

1) Volatility has been declining ever since the first Bitcoin exchange-traded products were launched by institutional asset managers like Blackrock and Fidelity in January 2024. In fact, 2025 has been the least volatile year in BTC’s history at the time of this writing, with BTC/USD currently being up just 1% year-to-date (and there’s only about 6 weeks left in the year).

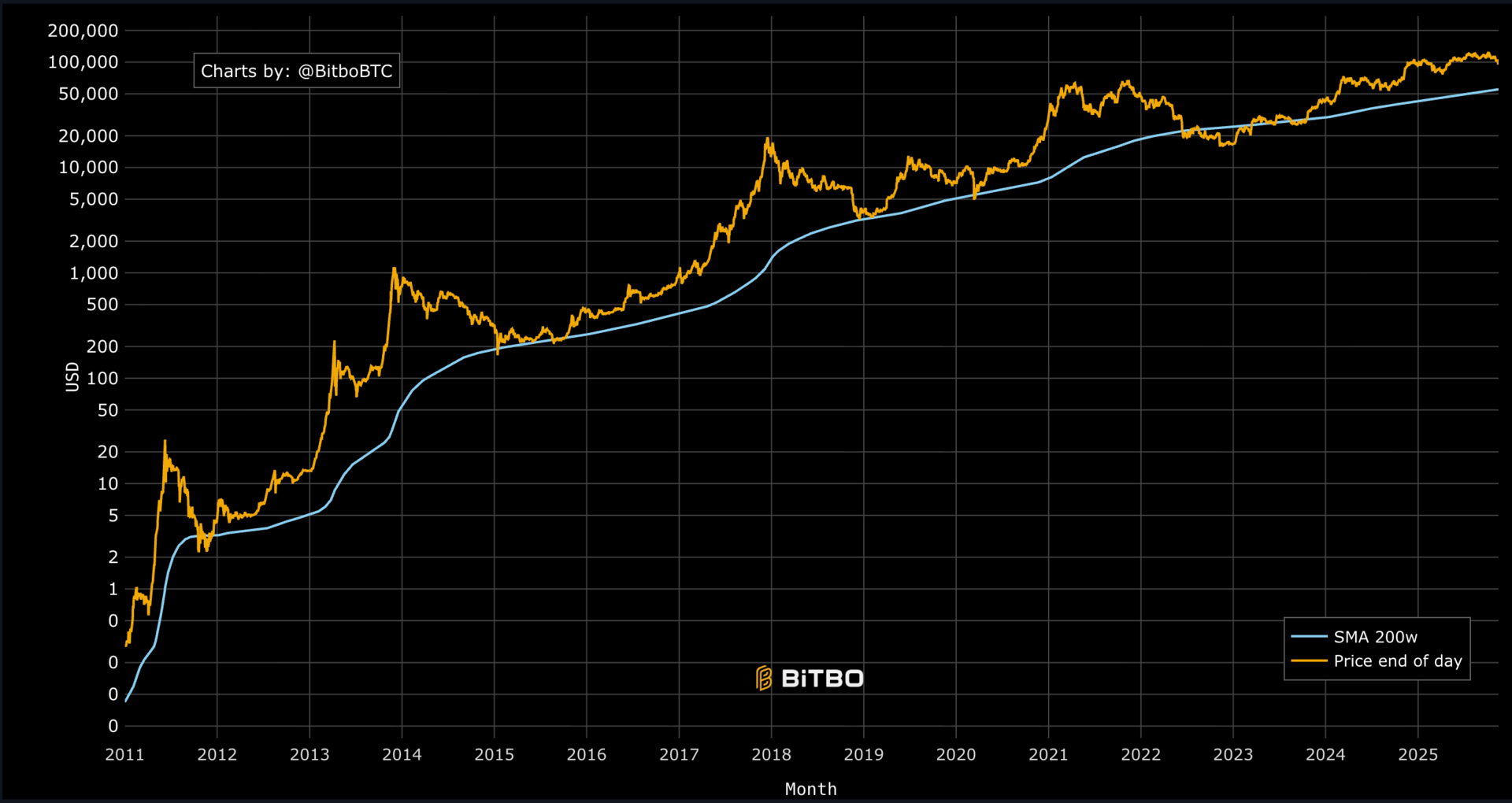

2) The 200-week moving average of BTC measured against the US dollar has never seen a significant dip since 2009 when Bitcoin was launched. In other words, the average price on an almost four-year timeframe has only ever gone up. This is why I always tell people to not even bother with BTC unless they plan on holding for at least four years (not financial advice).

BTC 200-week simple moving average (teal line) vs price in USD (orange line). Source: BitBo.com

Here’s an interesting article from Bitcoin Magazine about the 200-week moving average on how it could indicate a lengthening bitcoin cycle, with a market top occurring sometime in mid-2026: https://bitcoinmagazine.com/markets/bitcoin-price-200-week-moving-average

That’s one potential outcome. The other, possibly more likely scenario is that the October highs of $126k represented the cycle peak, and today the market is entering its usual 12 - 18 month bear phase.

⚙️ Price is Not Everything

There are always more important things happening in Bitcoin than the market price. This technology affords people the ability to control their savings and transactions in a way that’s never been possible before.

But it’s a constantly evolving piece of software, and in order to succeed long-term, it must remain sound money and fulfill all the roles that money historically has: a store of value, medium of exchange, and unit of account.

This week on the Hard Money Dispatch podcast, I had a fascinating conversation this week with Gil Roberts , a finance professional and Bitcoin advocate who has been working on some really interesting things regarding Bitcoin node software. His team aims to provide a third option to Bitcoin Core and Bitcoin Knots, which are currently the two most popular versions of the Bitcoin software that people can run on their full nodes.

You can learn more about it at TheBitcoinCommons.org.

Listen to the full podcast on:

Apple Podcasts: https://podcasts.apple.com/us/podcast/beyond-core-and-knots-rethinking-bitcoins-future-ft/id1649814816?i=1000736200089

And while you’re at it, if you could leave a 5-star review, it would help me out a lot!

The podcast has been growing in popularity lately and I’ve been receiving a lot of requests from people who want to be on the show.

It’s a strange and unexpected thing, since I was always a writer first and don’t particularly enjoy being on camera. But apparently people enjoy the audio and visual content!

You can also watch the podcast on YouTube: https://www.youtube.com/watch?v=ykU6SKQzECk

That’s it for this edition of Hard Money Dispatch.

Till next time,